From the March 2013 issue of Car and Driver

Long before the leaders of General Motors, Ford, and Chrysler were summoned to testify before a congressional committee in late 2008, evidence of the decline of the American carmakers was manifest. That “the Detroit Three” had replaced “the Big Three” in colloquial reference reflected a begrudging acceptance that a generation had passed since this ruling troika had set the industry’s agenda. Yet an almost British belief in “keeping calm and carrying on” was pervasive around Motown. Those who grew up in the industry were accustomed to riding out economic downturns with stopgap measures, confident that they were just one hit product—one minivan or Taurus—away from returning the champagne to executive dining-room menus.

But then the one-two punch of exploding health-care costs and rising fuel prices hit hard, and the global financial crisis nearly finished off Detroit. Ignominy on Capitol Hill was followed by anti-bailout political grandstanding, and America nearly lost much of its domestic auto industry in the partisan hostilities. Instead, two federally managed bankruptcies, a merger, and a thorough restructuring saved the three, yielding companies that now look very different than they did in 2007.

As the Big Whoa recedes into history, a major question remains: Are the Detroit Three now positioned for success, or did their brushes with death merely foreshadow a greater reckoning? We’ve pulled together all the pertinent indicators, read the tea leaves, and examined all those five-year plans that seem to change every year. What follows is our prognosis.

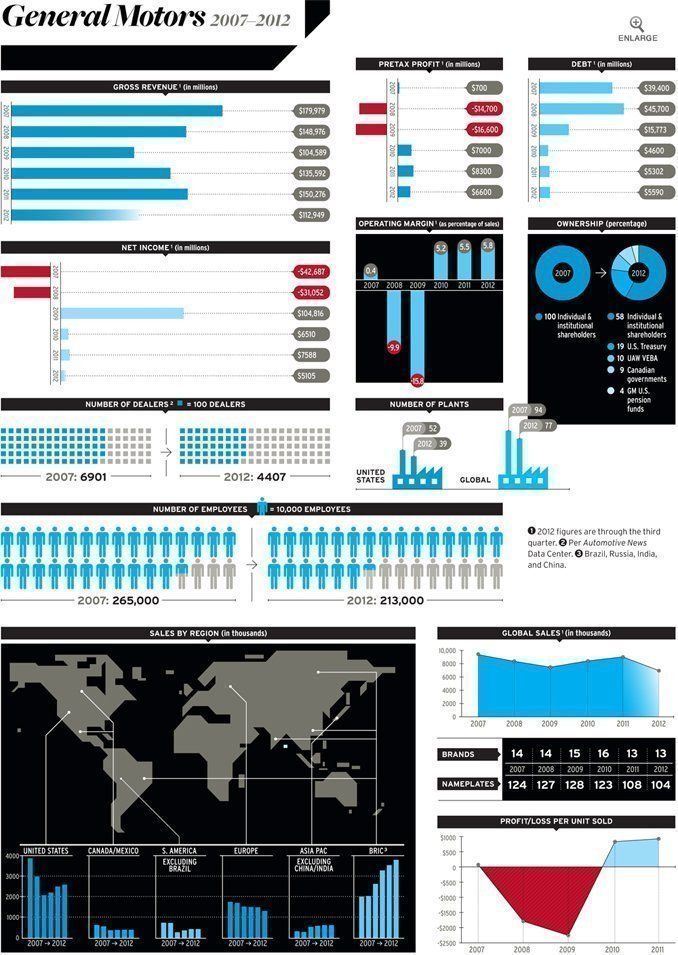

To many, the notion that the world leader in automotive production from 1931 to 2007 could go bankrupt still seems like a dystopian nightmare. But after two decades of trying to diversify and globalize the company, GM was floundering by the mid-2000s. Sales volume and profitability had imploded. Hampered by high labor costs and unwieldy dealership agreements, the pre-bankruptcy management had neither the backbone nor the cash to pare its operations. Enter the feds and a government-backed Chapter 11 bankruptcy.

GM’s present is a lot sunnier than in those murky days of multi-billion-dollar losses, but the company remains dogged by the stigma of government ownership. The U.S. and Canada, along with the province of Ontario, all became post-bankruptcy stockholders. And while the governments’ stakes have declined with the issuance of public stock, the company has been tainted by the “Government Motors” moniker. This has put off some former loyalists, especially in the middle-American heartland that was once a General Motors stronghold, and turned others aggressively against the company and its nameplates.

GM folded three of its low-volume brands—Pontiac, Saturn, and Hummer—and sold off Saab. While overall sales initially declined, so did the incremental costs of operating those brands, from product development to sales and marketing. That leaves General Motors in the position of reaping potentially higher profits from its remaining divisions. Though the company’s pretax profits are currently lower than those of crosstown rival Ford, the General has a cleaner balance sheet, lower labor and vehicle-development costs, and fewer outstanding financial obligations. That means it should be outearning Ford by the end of 2015.

| THE WHOA YEARS | ||

BEST & CADILLAC CTS-V WAGON Ballsy, beastly, and beautiful, this wagon helped bring that body style back from the dead. It's the kind of adventuresome car that gave GM its reputation in the first place. | WORST (TIE) CHEVROLET IMPALA SS AND PONTIAC G3 Though the goals were about as far apart as those of any two cars within GM, both were brand perversions as disappointing as they were inevitable. | |

But when discussing the new General Motors, words like “potential” and “should” tend to pepper the conversation. Post-bankruptcy CEO Dan Akerson’s background as a private-equity manager specializing in telecommunications is a nonconventional one for someone at the helm of a major automaker. GM is a complex, cash-hungry manufacturing business dependent on stoking demand for expensive purchases in a market where the differences between products are increasingly narrow.

Then there’s GM’s corporate culture. Many mid-level managers believe GM “dodged the bullet,” but they have quickly returned to business as usual, allowing the old cover-your-butt, initiative-killing autoimmune system to creep back into the organization. Potential problems are being passed up the management chain, causing decisions to be made later in each program by people who aren’t equipped to make them. GM needs new development processes that produce fresh ideas, but the existing body doesn’t want to stick out its neck. Such was the case with the 2010 GMC Granite concept car, an intriguing potential competitor to the Scion xB and Kia Soul featuring a radical door design. GM’s middle management got nervous and put up enough barriers to prevent the doors from being developed, which eliminated the car’s reason for being.

Turnover at the top hasn’t helped. Numerous high-profile firings and resignations have made the middle layer more unwilling to make waves. While the guys at the pointy end of the employee pyramid see this, they haven’t developed a way to deal with it.

Yet General Motors still operates from a position of strength. Its size is an asset in a world of fewer large suppliers. Some 80 percent of its domestic model range is slated to be revised or replaced by 2015, meaning it should soon have fresh product to drum up sales. Perhaps more important, the company’s sales organization has weaned itself off incentives, no longer giving away obscene bundles of cash to move the metal. GM Europe is the mess diminishing the company’s overall profitability. Opel was in bad enough shape before the 2005 European launch of the Chevy brand pitted two GM divisions against each other. Then there’s the nascent tie-up with money-losing PSA Peugeot-Citroën. Managing this debacle will be the largest single issue in GM’s ongoing viability as a global automaker.

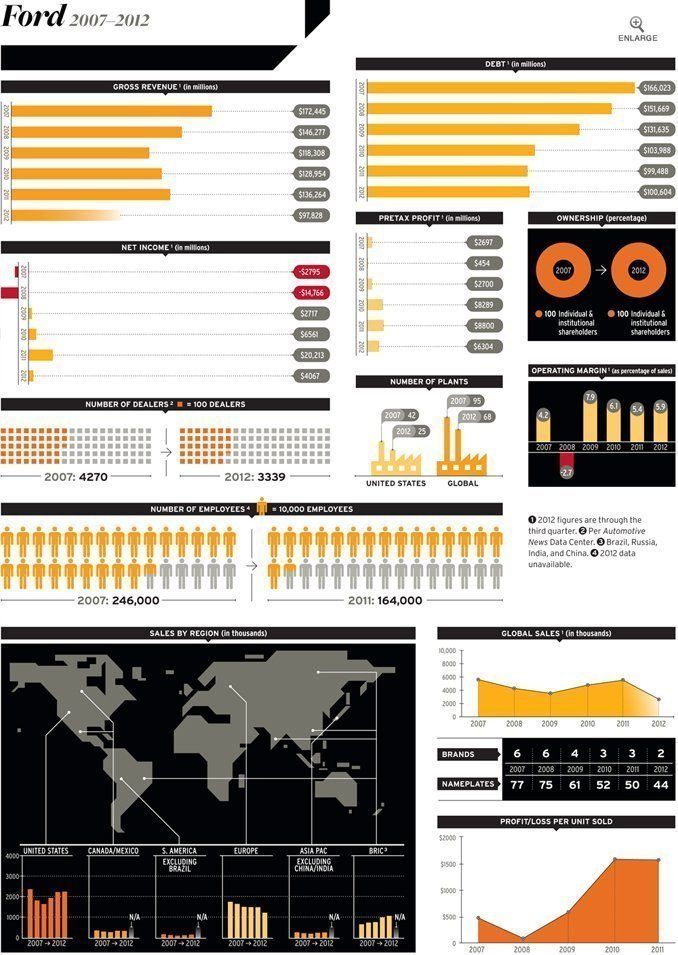

Europe is a problem for GM, but it’s a problem for every company that sells cars there, including Ford. Its European design and engineering operations have become crucial to the company’s North American passenger-car lineup; this is a byproduct of a restructuring that began just before the financial world blew up.

Presciently enough, the Ford family realized in 2006 that the company’s survival would require new blood. It tapped Boeing’s commercial airplanes chief executive, Alan Mulally, to become both president and CEO of Ford Motor Company. Even before Mr. Triple Seven’s arrival in Dearborn, Ford had begun negotiating a $23.6 billion line of credit by mortgaging the company’s assets—all of them, including the Ford oval itself. It seemed crazy at the time, but the reasons given proved sound: to fund global reinvestment in product and, as Mulally said, to “provide a cushion to protect for a recession or other unexpected event.” When the collapse hit and credit lifelines were no longer available, Ford still had its cushion. For a while.

But the slump continued and historically high gas prices began to dim consumer demand for trucks and SUVs, Ford’s key profit sources. Mulally understood that the ultimate bill for saving Ford was going to be appreciably more than $24 billion. While GM and Chrysler went to Capitol Hill, hat in hand, looking for cash, Ford tried to arrange a loan guarantee, not unlike Lee Iacocca’s famous 1979 Chrysler deal. When it was clear that nobody in Washington was interested in cosigning a Ford loan, Mulally returned home to Dearborn determined to see Ford survive on its own.

| THE WHOA YEARS | ||

BEST & FORD MUSTANG BOSS 302 The less-rich man's BMW M3, the Boss is a track-hungry paragon of continuous product evolution. What Ford has done to develop the car's stick axle is highly impressive. | WORST FORD FOCUS (2008–2011) A poorly reheated first-generation car that somehow managed to nullify its predecessor's excellence, this Focus is the nadir of the car's history, and indeed Ford's worst of the Whoa era. | |

It was the only play he could make, because a federal bailout wasn’t an option. Despite being publicly traded, Ford is functionally controlled by the Ford family, with its stock split into two categories. In round numbers, Ford Motor Company now has 3.7 billion “common” shares in circulation, along with 71 million “Class B” shares. The Class B shares are owned almost entirely by the Ford family and by its philanthropic arm, the Ford Foundation. Before releasing additional shares of Ford common stock to cut its debt and to help fund the UAW’s Voluntary Employees Beneficiary Association (VEBA), the company rearranged the voting power of the two share classes to maintain the family’s control. Now the sum of all Ford common shares holds 60 percent of the general voting power, with Class B getting the remaining 40 percent, regardless of the total number of common shares. More important, income paid from the Class B stock bankrolls the family. As one of the government’s conditions of a federal bailout was disallowing any shareholder payout, the no-dividend provision would have meant no deal.

To get the capital needed to keep Ford’s Way Forward initiative moving, Mulally and his lieutenants held a fire sale. Aston Martin, Jaguar, Land Rover, and Volvo were all pawned off. Though Lincoln was kept on life support, Mercury was euthanized. Mulally refocused the entire organization on the core Blue Oval brand and implemented the “One Ford” plan to globally standardize products.

Shedding the various brands freed up some engineering resources and significant marketing funds. While that bodes well for the future, One Ford is a double-edged sword. It offers tremendous potential savings through platform reduction and purchasing efficiencies, and if all markets in the world were the same it would work. But that’s not the case, just as it hasn’t been in the three decades Ford has been attempting similar initiatives. Thus far, Ford hasn’t demonstrated Toyota’s, VW’s, or even GM’s ability to make platforms flexible enough to stretch across multiple segments.

As with GM, Ford’s European operations are bleeding. Ford doesn’t have a premium brand there to battle the German luxury makers. Worse, the move downmarket by Audi, BMW, and Mercedes continues to erode Ford’s sales of vehicles with higher profit margins. At the other end of the market, Hyundai/Kia and Renault-controlled Dacia are making inroads against Ford’s entry-level products.

Things are different on our side of the Atlantic. Ford is currently outearning both General Motors and Chrysler. But in light of the company’s lack of a global luxury brand, Ford has worries that extend beyond a potential decline in the still-lucrative truck market.

Ford will find it hard to improve its position through 2019, and with an especially weak partner in China, the company may have to look to India, where, thanks to a younger population, its concentration on small hatchbacks could prove to be hugely profitable.

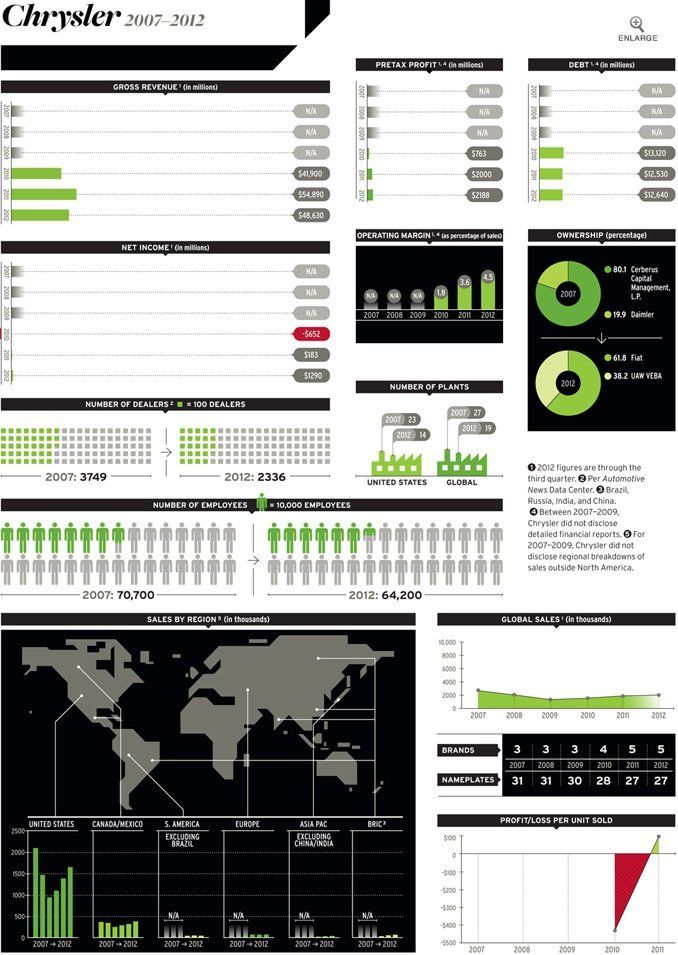

It sounds strange, but Chrysler ceased to exist from August 3, 2007, to June 10, 2009—at least as a publicly traded company. This was when 80.1 percent of DaimlerChrysler Motors Company LLC was owned by Cerberus Capital Management L.P. We mention this because during this time, Chrysler was effectively a private firm under Cerberus control; as a result, financial data was released only to the owners, Cerberus and Daimler. Today, neither will say what Chrysler earned or lost.

Over the past year or so, Chrysler has posted strong month-over-month sales increases, but this is largely because volume had slipped so much under Cerberus. Simply put, the firm starved Chrysler. Global sales fell from 2.7 million units in 2006 (the last full year before Cerberus’s involvement) to 1.32 million in 2009. While the slumping global economy was partially responsible for halving sales, no other major automaker experienced such a precipitous decline. Responsibility rests firmly with Daimler, for initiating commercially disastrous products, and Cerberus, for stifling development and marketing investment. Anything, even bankruptcy, turned out to be an improvement.

Thanks to years of mismanagement, Chrysler in the economic collapse was a dead man barely walking. In the weeks before it tumbled into bankruptcy, Chrysler sought a tie-up with a capital-rich automaker to save itself, but talks with Volkswagen, Nissan, Tata, and several Chinese automakers, including SAIC Motor, FAW, and BAIC Group, were fruitless. Of the many companies the failing automaker contacted, only Fiat expressed interest in a partnership.

| THE WHOA YEARS | ||

BEST & JEEP GRAND CHEROKEE As the first unibody utility to offer real off-road capability, the Grand Cherokee redefined what an SUV could be. The current-generation Grand Cherokee is America's Range Rover. | WORST DODGE CALIBER The Caliber wasn't just bad, and it didn't just kill Chrysler's prospects with young buyers. It also spawned the most timid Jeep ever, the Compass, and for that we cannot forgive Chrysler. | |

As Chrysler went into its quickie 30-day bankruptcy, the majority of automotive analysts and pundits would have bet it all on the Detroit Lions winning the Super Bowl rather than a Chrysler-Fiat partnership succeeding. “Fiat Won’t Be Chrysler’s Savior,” proclaimed a Bloomberg Businessweek headline on the day the companies inked their partnership. It turned out to be an insightful bit of journalism, but not in the way its authors intended.

Under Sergio Marchionne, CEO of both Fiat SpA and Chrysler, the two companies began a process of consolidating powertrains, platforms, financial practices, and purchasing operations. It became obvious that the profit earned by each of Chrysler’s volume vehicles was significantly higher than Fiat’s better-selling models. For example, the profit from each Jeep Grand Cherokee sale was 16 times greater than that earned by selling a Fiat Punto. Additionally, with its cleared post-bankruptcy balance sheet and two-tier wage structure, Chrysler could offer better long-term profitability than any of Fiat’s European operations.

Before the DaimlerChrysler “merger of equals,” Chrysler had a significant international operation with vehicle assembly carried out in both Europe (Austria) and Asia (China), but overseas sales soon dwindled. With Fiat well established in Europe and South America, and Chrysler strong in the U.S., the two brands now complement each other from a global-marketing standpoint. Jeep’s clearly defined image throughout the world (one that not even the Germans could tarnish, though not for lack of trying) makes it the brand that will complete the group’s global footprint. Fiat, with no SUVs of its own, appreciates Jeep’s strength and will be selling the brand through its dealer network in South America and in selected European markets.

While to some it seemed the Chrysler-Fiat affiliation would be the corporate equivalent of tying two poor swimmers together and dumping them in the Atlantic, the reality is a relationship where the whole seems to be greater than the sum of its partners.