When your employer goes into meltdown, you brace yourself for the worst. Perhaps you anticipate a series of recriminatory meetings. Perhaps you fear your reputation will be tarnished. Perhaps you even worry about losing your job.

Sometimes, of course, it goes a bit differently. As it did for Richard Harper, who went to bed one night in 2001 as a middle manager at Enron, and woke up to find himself running a company.

Harper, who worked for Enron in London, had been with the multinational for eight years when the accounting scandal that would eventually unravel the business initially came to light. The head of an analytical group that provided support to the energy giant’s gas traders in Europe, he considered himself a loyalist. But there was no doubt that something strange was afoot. In London and the US, people were being made redundant, and confusion reigned. When the main companies were first put into administration, he remembers, “it was chaos for a day or two, and they basically said: unless you’re told otherwise, go to floor X, and when they got there, people were told they hadn’t got a job any more. I went to that floor because nobody told me otherwise, but then they called me to come back in the next morning.”

Thus reprieved, things would just get stranger. Harper had been nominated as a director of one of the smaller subsidiaries that Enron used to do business in Europe. He didn’t know exactly what was going on. “But,” he says ruefully, “everyone more senior than me did.” One morning, as the company entered its final tailspin, Harper found that a peculiar thing had happened overnight. “Everyone else had resigned from this company,” he says. “I woke up to find I was the sole director of it.” (That meant he would be charged with putting it into administration; eventually, he persuaded Enron’s administrators to keep it open.)

As Volkswagen’s 600,000 employees are no doubt discovering, it’s a curious business, working at a wounded giant, where your professional identity can seem threatened and subverted at the same time: half death row, half non-uniform day. Your career may be in ruins; on the other hand, for a brief moment, your life may suddenly be too surreal, or exciting, for you to care. Unfortunately, that phase doesn’t last: sooner or later you surface, and survey the wreckage. “It was exciting for a little bit,” says Kate, who was working at Northern Rock’s head office in Newcastle when the bank’s collapse began in 2007. “And then you realise it’s entire families’ livelihoods. And then it’s not exciting any more.”

What is happening at Volkswagen, and what happened at Northern Rock and Enron, is not your run-of-the-mill organisational crisis. Nobody saw the extraordinary scandal over VW’s diesel emissions coming, and that makes the sudden trauma all the harder to comprehend.

Neil Robson, a partner at restructuring advisers Talbot Hughes McKillop, had his own experience in the corporate crucible as finance director of Leeds United football club after a new board took over to try to correct the previous management’s lavish expenditure. He sees two categories of crisis: “You have the situation where you’re just in a business or an industry which is going through inevitable change,” he says. “And people can to some extent accept that. And then you have event-driven situations. VW is one of those. It wasn’t a poorly run, unprofitable business. But now it’s going through a major trauma.” So what should the rank and file, who are about to be exposed to that trauma, expect?

First of all, as Harper’s experience suggests, structures get loose – fast. And if that’s the case at a behemoth like Enron, it’s all the more pronounced at smaller operations. When Kids Company began its death spiral earlier this year, Charlie Porter was a fundraising account manager working as part of a team of seven and reporting to two senior executives. That didn’t take long to change. “People were handing in their notice every week,” she says. “The director of fundraising left after the first article came out, and then my other boss handed in her notice. And that meant me and one other girl handling our accounts, and we knew neither of us could leave because the other person would be in the shitter.”

It was hardly her fault, but at the age of 26, Porter found herself shouldering a terrible responsibility: leading the doomed effort to secure funding just as it became more desperately needed than ever before – and not in a business whose concern was shareholders, but a charity whose concern was children. (So tough was the sell that when Yahoo didn’t reject an approach out of hand, she and her colleagues immediately thought: is no one there paying attention to the news?) “I came in as the most junior person, and suddenly we were having talks with big banks,” she says. “It was pretty upsetting by the end. You’d go home and think: ‘Shit. I don’t know how I’m going to get the money in.’ We were drowning.”

Although a crisis can require massive endeavour to stave off extinction, sometimes the nature of the problem can mean that it’s already too late. When that happens, the priority may change: from righting the boat to making sure everyone goes down without too much screaming. When the scale of the problem became clear at Northern Rock, Kate initially had to handle calls from anxious mortgage customers who wanted to know if their debts would be called in. After a while, new business, unsurprisingly, tailed off a bit, and her superiors tried to come up with ways to keep staff cheerful. “In December, we had a 12 days of Christmas competition,” she says. “Senior management would come round to see who had made the best version of that day’s things, maids a-milking or whatever, and they gave out prizes.” Er, hang on. How were you making maids a-milking? “Oh,” says Kate. “They brought in craft materials.”

That may seem a surreal survival mechanism at a business on the brink of disaster. At Kaupthing, the Reykjavik bank that briefly prospered as Iceland built an economic miracle on sand, the speed and severity of the collapse left staff with almost nothing to do. Ásgeir Jónsson, now an academic and author of a book about the crisis, Why Iceland?, was the bank’s chief economist at the time. The scale of the catastrophe first became apparent internally, he says, two or three weeks before it became public knowledge. As word got round, the bank’s creditors started to refuse to pay. “They would not answer the phone. They would say that the person you would like to talk to is on the toilet. He will call you later. But, of course, he would never call you.”

As global finance made an unseemly dash for the loo, there were, meanwhile, a lot of calls to ignore in Reykjavik. “Everyone who you owed money, they would be ringing you constantly.” And then the bank went down. “All the phones just went silent. Yes, that was an eerie moment.” Still, says Jónsson, as a point of pride, “we always went to work. What we would do is we would play chess. It is the national sport of Iceland. We would play endless chess tournaments.”

It’s striking that there’s something about this very strangeness that distracts its participants from total misery. As often as not, people contending with professional catastrophe find it, rather to their surprise, interesting. Tom Latchem was TV editor of the News of the World when its abrupt closure was announced in 2011. It was “a hugely distressing time”, he says, at pains to acknowledge the devastating impact on many people’s careers. But, he adds: “It was quite an exciting time, too, to be in the middle of something that we normally watch from the outside and report on.”

The fevered last few days of the NOTW’s existence barely left time to mourn: after the announcement on Thursday, and a night in a London Bridge karaoke bar that didn’t end until 5am, there was a paper to get out. “We wanted it to be a good one,” says Latchem. “We wanted to work really hard on it.” Add that to saying goodbyes, emailing contacts, filing urgent expenses claims, and more drinking, and there wasn’t a lot of room for reflection. The sadness only came to the foreground come Sunday morning.

Camaraderie likewise leavened the awfulness of the situation at Kids Company – at least among those who remained. “We were all feeling a bit abandoned,” says Porter. “But that gave us this real feeling of being in it together. I did say, at one point, maybe we should jump off the Titanic now. And someone said: ‘But you can’t leave! You guys are the orchestra playing as it sinks!’” Sometimes, she adds, “the only thing you could do was laugh”.

That disjuncture is typical, says John Arnold, professor of organisational behaviour at Loughborough University, and former head of the Institute of Work Psychology at the University of Sheffield. But he warns that whatever esprit de corps develops at Volkswagen may be only skin deep. “If there is strong condemnation from outside the company, as there appears to be in this case,” he says, “then that is likely to increase a sense of in-group identity and loyalty, especially among those who were already loyal. A sense of ‘us against the world’.”

Perhaps, he says, VW executives will try to burnish this by suggesting that other businesses might have got away with something similar. In the end, though, the ugliness of the situation will come through. “Solidarity will probably be more apparent in communications with the outside world than inside the company, where they may be fighting like rats in a sack over who is to blame.”

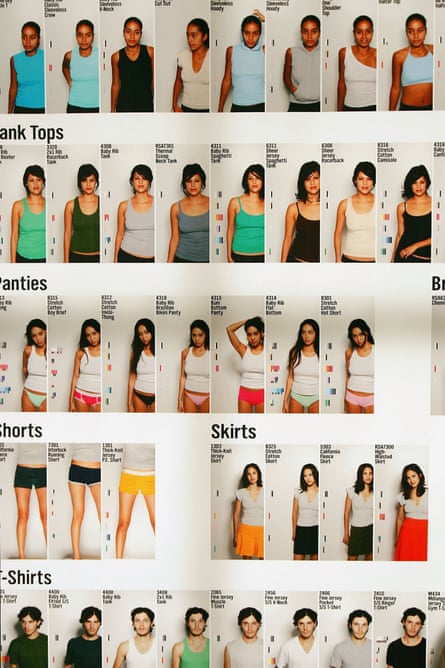

And when things start to go sour, they can go very sour indeed. In the aftermath of founder Dov Charney’s departure from American Apparel and its ensuing bankruptcy, one staffer says a mood of what sounds like fear and loathing has developed. Regular protests by garment workers outside the headquarters, which also houses the retailer’s factory, haven’t helped; last month, one of them involved smashing a pinata effigy of the new CEO, Paula Schneider. A new fence and phalanx of security guards have only made the mood uglier. “There’s just this sense of hostility,” says the staffer, who works in administration. “The overall mood hasn’t been good. The office empties at 5pm; you’re just doing your contracted hours and getting out of there. It didn’t used to be like that.” The office has been lent a dystopian feel by a looping video on the canteen’s flatscreen TVs of Schneider issuing a reassuring statement. “It’s weird,” the staffer says. “It feels like Minority Report.”

The trauma at Kaupthing was compounded by the sense that this was not a corporate catastrophe, but a national one. Jónsson says: “We were worried that we would not be able to save our country. So, you just had to try to keep on going, because if you get too entangled in thinking about these things, like what people might think of you, you are finished.” Jónsson had 15 people working for him, and so, he says, “I just tried not to show any signs of panic.” Even as the disaster crept up, though, something kept his team united.

“The crisis really brought people together,” he says. “People would watch movies together. Morale was much higher.” He pauses. “There is a saying in Icelandic: ‘A mutual shipwreck is a happy one.’”

Jónsson was, in one sense, cursed by his seniority. Like everyone I spoke to, he said that the hardest part of the experience was the isolation it brought with it; the sense of occupying a polluted bubble, which no one breathing the fresh air outside could ever fully understand. In Iceland, association with the economy’s collapse carried a huge social stigma. “It is very popular to begin your day in the hot tub, where people meet and talk,” he says. “It’s like a coffee house. Let’s just say I could not go to the hot tubs for two or three years.”

American Apparel’s reputation has been so damaged, says the administrative worker, that “I’m no longer really proud to work there. If someone asked what I did, I’d say I work for a retail company, not that I work for American Apparel.” At Leeds United, Robson says, “friends would pump you for information over the dinner table, but you had to be very circumspect”. And Porter paints a painful picture of the difficulty of explaining the situation to anyone on the outside. “Maybe I should have talked about it more,” she says. “But you didn’t think anyone would understand. I thought the whole world was against me. You feel the safety blanket has gone.”

As isolating experiences go, it’s hard to beat that of Jónsson, who had to live with the knowledge that Iceland might be about to run out of banknotes. As more and more people took their money out, he remembers, “they called the UK and asked for an express delivery of banknotes, and they were told it would take three months. If this had been known, it would have been much more serious.” Afraid of what might happen, he says, “I decided I would have to at least get some. So I went to a branch to get some money out, and when I got there, the employees all stood up and asked me why I was taking this money.” (Iceland is a small country; everyone knows everyone.) “Well, I told them I was going to pay a carpenter. I was going to evade tax.” He pauses. “I don’t think many people know how close it came.”

Whether Volkswagen survives or not, those who have lived through its darkest days will remember it for ever. “I was young, so I was OK,” says Kate, of Northern Rock. “But seeing the reality and the anxiety and the doubt and all the people who knew their families would be so badly affected ... it had a massive impact.” Porter says that she was so “burned” by the experience that, while she’ll always volunteer and donate, she would find it hard to work for a charity again. She remembers a moment with her immediate boss as they waited to say goodbye to Camila Batmanghelidjh, Kids Company’s embattled founder, on the last day. Before they went in to see Batmanghelidjh, Porter turned to her boss and said: “I think you’ve done an amazing job.” He looked back at her and replied: “Well, Charlie, at the end of the day, we failed.” He started to cry. “And then,” Porter says, “we all started crying, too.”

And yet there may be some solace for those at VW. Porter is proud to have “learned to stand on her own two feet”. “Those few days forged friendships,” says the NOTW’s Tom Latchem; moreover, it gave him the impetus to make a career for himself as a presenter on Fubar radio and as a freelance writer. Robson and Enron’s Richard Harper have both gone on to careers trying to turn around companies nearly as traumatised as the ones they worked for. “From my perspective, it was all right,” says Harper. “I got a career out of it.”

For every one of them, there’s the intoxicating sense, at least, that they have lived through something more intense than most people will know in their working lives. Latchem remembers walking out of the NOTW office on that last night. “It was one of the most incredible buzzes anyone could ever experience,” he says. “That sea of flashbulbs going off, you’re like, ‘Woooahh!’ You’re part of a moment of history.”

In Reykjavik or Wapping, Newcastle or Los Angeles, and perhaps even in Wolfsburg, it turns out that, somehow or other, life goes on. “You learn,” says Jónsson, “that it’s not the end.”

Comments (…)

Sign in or create your Guardian account to join the discussion